Helios and Matheson Analytics Inc. (HMNY) has been a subject of intrigue in the stock market, particularly due to its association with MoviePass, a once-promising subscription service that disrupted the movie-going industry. This article explores the history, rise, and fall of HMNY stock, analyzing the factors that contributed to its volatility, investor sentiment, and its lasting impact on the market.

Understanding Helios and Matheson Analytics (HMNY)

Background of HMNY

Helios and Matheson Analytics was a data analytics company that primarily provided services to businesses seeking advanced technological solutions. Founded in the 1980s, the company was relatively obscure until its acquisition of a majority stake in MoviePass in 2017.

Acquisition of MoviePass

The acquisition of MoviePass marked a turning point for HMNY. MoviePass, a subscription-based service that allowed customers to watch unlimited movies for a fixed monthly fee, gained significant traction among consumers. However, this ambitious business model came with inherent risks, as the cost of providing unlimited access often exceeded subscription revenue.

The Meteoric Rise of HMNY Stock

Initial Investor Optimism

When HMNY acquired MoviePass, investors initially saw great potential in the combination of data analytics and entertainment. The stock surged in value as the company promised to revolutionize the movie industry by leveraging user data for targeted marketing and partnerships.

Peak Valuation

In late 2017, HMNY stock reached its peak, fueled by the rapid growth of MoviePass subscribers. The company became a popular topic among retail investors, with many betting on its disruptive potential. At its height, MoviePass boasted over 3 million subscribers, further driving optimism.

Challenges Faced by HMNY and the Decline of Its Stock

Unsustainable Business Model

Despite its popularity, MoviePass’s business model was fundamentally flawed. The company charged $9.95 per month for unlimited movies, but the average ticket price for a single movie exceeded this amount. As a result, MoviePass incurred significant losses with every subscriber.

Financial Troubles

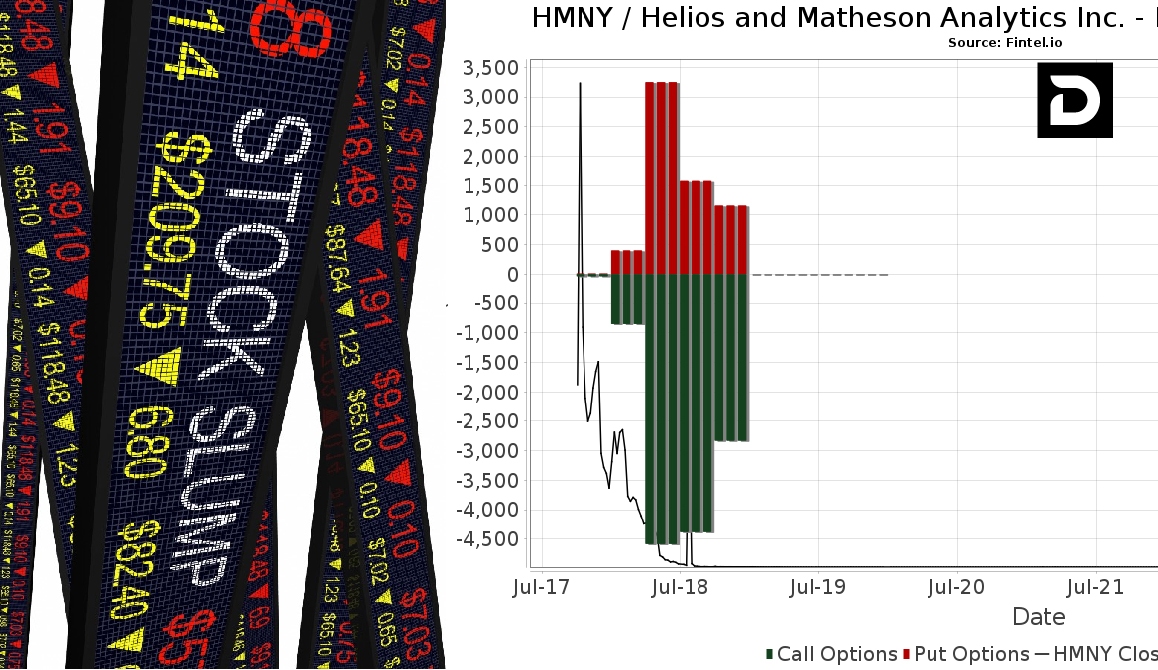

HMNY struggled to sustain the financial demands of MoviePass. By mid-2018, the company was burning through cash at an alarming rate. To address its liquidity issues, HMNY issued additional shares, leading to dilution and a sharp decline in stock value.

Regulatory Scrutiny

The company also faced scrutiny from regulators, with allegations of misleading investors about its financial health. This further eroded confidence in HMNY, prompting many institutional investors to divest their holdings.

Investor Sentiment and Market Reaction

Volatility of HMNY Stock

The stock became highly volatile, with dramatic swings in value as news about MoviePass and HMNY’s financial struggles surfaced. While some speculators attempted to capitalize on the price movements, long-term investors faced significant losses.

Delisting from NASDAQ

By late 2018, HMNY stock had plummeted below $1 per share, leading to its eventual delisting from NASDAQ. This marked a critical juncture in the company’s history, as it struggled to regain credibility and market presence.

The Aftermath of HMNY’s Decline

MoviePass Shutdown

In 2019, MoviePass ceased operations, marking the end of an ambitious but unsustainable venture. Its shutdown symbolized the broader failure of HMNY’s strategy and the risks associated with aggressive growth without a solid revenue model.

Legal and Financial Ramifications

HMNY faced multiple lawsuits from investors alleging fraud and misrepresentation. The company eventually filed for Chapter 7 bankruptcy in 2020, effectively ending its operations and leaving shareholders with little to no recourse.

Lessons from HMNY Stock

Importance of Sustainable Business Models

The rise and fall of HMNY underscore the importance of a sustainable business model. While disruptive ideas can generate excitement, they must be backed by financial viability to ensure long-term success.

Risks of Speculative Investing

HMNY’s story serves as a cautionary tale for investors, highlighting the risks of speculative trading in high-volatility stocks. Conducting thorough due diligence and understanding the fundamentals of a company are critical to making informed decisions.

Market Dynamics and Retail Influence

The surge in retail investor interest in HMNY also illustrates the influence of collective sentiment on stock prices. However, it also emphasizes the need for investors to be cautious about market hype.

Current Status of HMNY Stock

Post-Bankruptcy Developments

Following its bankruptcy, HMNY stock is no longer traded on major exchanges. However, remnants of its legacy remain in discussions about failed ventures and the challenges of disrupting traditional industries.

Potential Revival of MoviePass

Interestingly, in 2022, MoviePass announced a potential relaunch under new management. While this is unrelated to HMNY, it demonstrates the enduring curiosity surrounding the brand and its innovative, albeit flawed, concept.

Conclusion

HMNY stock represents a dramatic chapter in stock market history, characterized by innovation, rapid growth, and an equally rapid decline. Its association with MoviePass captured the imagination of investors and consumers alike, but its story ultimately highlights the dangers of unsustainable business practices and unchecked speculation.

Read more: Steve Spitz Net Worth: An In-Depth Analysis of His Wealth and Success